The accountant will dig deeper into the financial records and analyze the business’s finances. An accountant can advise you on ways to conserve costs and increase profits and help you understand the financial impact of business decisions. As an alternative to accounting, bookkeeping is an appealing field for professionals who want to work with financial statements and computers. This profession has fewer entry-level requirements than accounting, meaning that individuals may be able to become bookkeepers more quickly than they would accountants. Customers schedule an appointment to have a bookkeeper review their transactions, and multiple schedules are available to choose from. You will have access to a client management portal, and can communicate with customers through video conferencing and messaging.

- Bookkeepers focus on day-to-day transactions and operations, whereas accountants are called on to provide financial advice and strategy recommendations.

- Bookkeepers offer a literal look at where you stand financially at the moment.

- Continuous training and the use of advanced tools can further strengthen this skill, enabling bookkeepers to excel in their role and support the financial health of the company.

- Bookkeeping is the practice of organizing, classifying and maintaining a business’s financial records.

- Bookkeepers must keep thorough, up-to-date records of organizational financial transactions.

Is Bookkeeping Certification Worth It? Benefits and…

But as with any other enterprise, running your own bookkeeping business takes some key elements of preparation and knowledge. If you’re organized and enjoy working with numbers, a job as a bookkeeper could be a good fit. Keeping the books is just one of the tasks modern bookkeepers might handle. They can also usually take care of some of the tax preparation so that your accountant has less to do (which is a good thing, because bookkeepers are less expensive than a CPA). But they won’t be able to help you with tax planning or handling your tax return.

Can You Automate Bookkeeping?

The transactions that need to be added will most likely be transactions generated outside of the accounting system, such as cash payments or handwritten checks. It could also involve matching deposits as customer payments to help manage accounts receivable or outgoing transactions as payments against vendor bills. Bookkeepers can wear many different hats depending on what a business needs. That said, most bookkeepers nowadays use business accounting software to do their work. Plus, there are a few things that almost every bookkeeper can take care of for your business. Though the role of a bookkeeper is multifaceted, there are some core tenets to what bookkeepers do.

- Accountants have higher education requirements and may have training in bookkeeping roles.

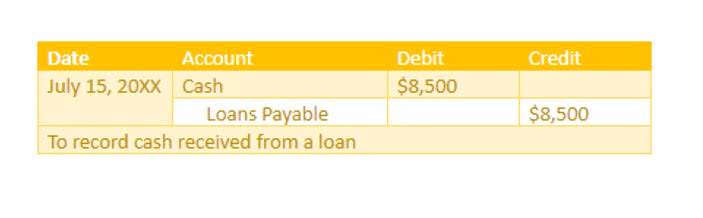

- Double-entry systems are more complex, and you have to tag the right transaction on the right account.

- Professionals who learn through on-the-job training can grasp essentials after about six months in entry-level roles.

- Working in the accounting field, you must have a knack for crunching numbers.

- Bookkeepers might also help you manage timesheets for hourly employees or overtime.

- Standard methods of bookkeeping are the double-entry bookkeeping system and the single-entry bookkeeping system.

What is Bookkeeping?

Bookkeepers must be diligent and meticulous when recording transactions, as even minor mistakes can have significant implications for a company’s finances. Bookkeepers are not required to have certifications or specific education unless required by a specific employer. However, completing a bookkeeping certification program can teach you basic accounting and how to perform bookkeeping tasks and has the potential to set you apart from other bookkeepers.

- One way to think about it is that bookkeepers lay the groundwork for accountants to analyze and prepare financial statements.

- An undergraduate degree will take 2-4 years and can pursue higher-paying positions in the field than those without a credential.

- The utilization of software allows them to efficiently record financial data, including transactions and account balances.

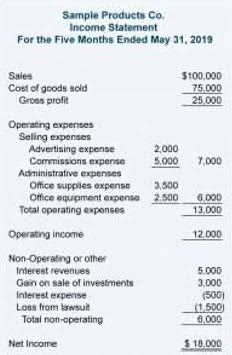

- Most bookkeepers will prepare three major financial statements for your business—the profit and loss statement, balance sheet, and cash flow statement.

- The responsibilities of a bookkeeper include a fair bit of data entry and receipt wrangling.

- Some aspiring professionals may pursue internships or practicums while pursuing postsecondary degrees or certificate programs.

- The primary financial statements include the income statement, balance sheet, and cash flow statement.

- Their duties may range from entering financial transactions into accounting software, to reconciling bank statements, and preparing basic financial statements.

- Bookkeepers are responsible for providing accurate, up-to-date financial information about a business.

- Accounting software allows bookkeepers to prepare these financial statements and share them with your accountant and tax preparer.

- Becoming a certified bookkeeper requires passing an exam to get a bookkeeping certificate.

- They can also usually take care of some of the tax preparation so that your accountant has less to do (which is a good thing, because bookkeepers are less expensive than a CPA).

Since bookkeeping is a more straightforward process than accounting, it is something that many people can (and do) opt to take care of themselves. As your business grows and you begin making higher profits, hiring staff and handling more transactions, however, it may make sense to outsource the details of bookkeeping to someone else. In this day and age, the providers you contract with don’t need to be in the same city, state or even time zone as you. Remote work has expanded across nearly every field, including bookkeeping.

Bookkeeping professionals have their own expertise based on the types of businesses and industries they serve. There you have it—all of the main skills that a bookkeeper can bring to your business. Your bookkeeper isn’t just consulting an accounting book and doing simple data entry—there’s so much more that goes into bookkeeping than many small business owners realize.

In conclusion, bookkeepers play an essential role in both financial reporting and compliance for businesses. They not only maintain accurate financial records and prepare statements but also ensure adherence to tax regulations and timely filings. A bookkeeper’s primary responsibility is to record and maintain financial transactions for an organization, such as accounts receivables, accounts payables, and payrolls.

After working in the field for at least a year, CPAs also need to take an exam. To meet the requirements for the CPA exam, some professionals what is a bookkeeper enroll in master’s in accounting programs. Most employers prefer hiring new bookkeepers who will learn from more senior professionals.

On the other hand, corporate bookkeeping involves managing subsidiary accounts and adhering to specific standards such as GAAP or IFRS. Bookkeeping plays a crucial role in the overall business strategy of a company. By maintaining accurate financial records, bookkeepers provide essential information that managers and business owners can use for decision-making, budgeting, and forecasting. In this section, we will explore how bookkeeping supports these important functions.